Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomU.S. NFP at an Inflection Point: Slowing Growth Calls for Market Caution

Executive Summary

The December release of the October and November 2025 Non-Farm Payroll (NFP) reports marks a notable inflection point for the U.S. labor market and the broader economy. While the October payroll contraction of -103,000 was clearly weak, the November gain of 64,000 jobs, although above expectations, remains well below replacement level. At the same time, the unemployment rate rose to 4.6%, reinforcing signals of a cooling labor market.

These developments should be viewed less as an immediate crisis and more as a warning for investors to recalibrate expectations. Supporting evidence from flat Retail Sales and a moderating Services PMI reinforces the view that the U.S. economy is transitioning into a slower-growth phase. This environment typically brings higher market volatility and increased risk of short-term corrections in U.S. equities and the U.S. Dollar.

This article examines the evolving labor market dynamics, corroborating macroeconomic indicators, the Federal Reserve’s policy outlook, and the resulting implications for key asset classes.

U.S. Labor Market: Clear Signs of Cooling

Job Creation Below Replacement Level

The November NFP print of +64,000 jobs falls well short of the estimated 100,000–120,000 jobs per month required to absorb new entrants into the labor force. When viewed alongside the sharp -103,000 decline in October, the two-month trend highlights a labor market losing momentum rather than stabilizing.

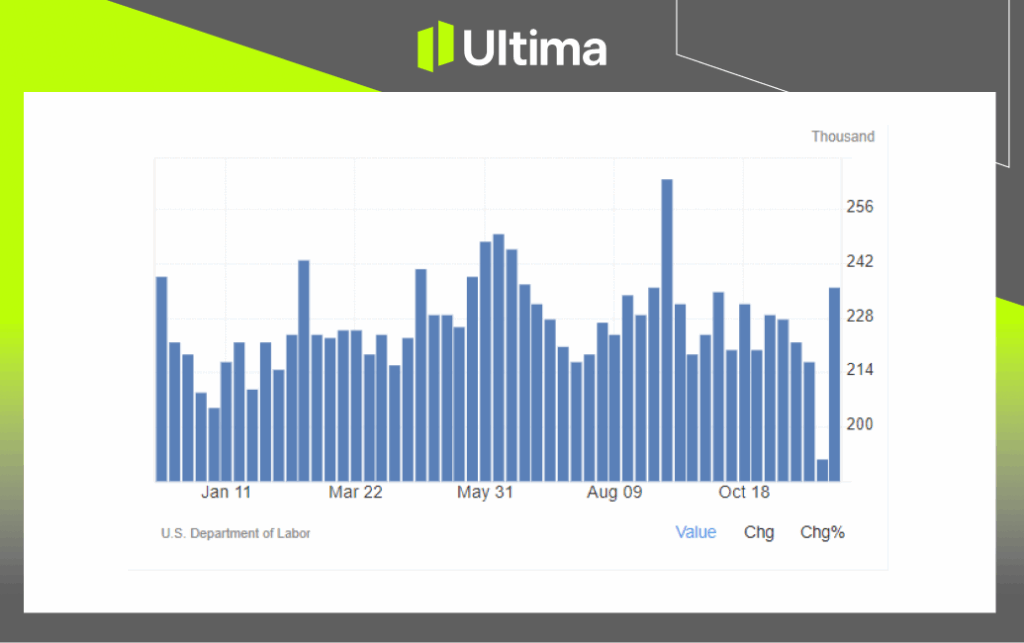

While this “stall speed” in employment does not yet point to an outright collapse, it clearly indicates that per-capita job growth is no longer sufficient to sustain the prior strength of the labor market. This weakness is further compounded by rising Initial Jobless Claims, suggesting that new job creation is increasingly unable to offset layoffs.

US Initial Jobless Claims | Source: U.S. BLS, Chart: TradingEconomics

Additionally, downward revisions to prior months by the Bureau of Labor Statistics (BLS) confirm that labor market softening began earlier than headline figures initially suggested. Historically, extended periods of sub-replacement job growth tend to precede GDP deceleration, signaling slower economic growth in subsequent quarters.

Unemployment Rate and the Sahm Rule

The unemployment rate rose to 4.6%, breaching the Sahm Rule threshold, defined as a 0.5% increase in the three-month average unemployment rate relative to its previous 12-month low. Historically, such breaches serve as early warning indicators of labor market deterioration.

While this does not guarantee an immediate recession, it often precedes a phase where companies transition from hiring freezes to more active workforce reductions.

Investor implication: Slower employment growth implies moderating income expansion, which could constrain discretionary spending and weigh on corporate revenue growth in the coming quarters.

Broader Economic Signals Point to Slowing Momentum

Macroeconomic data released alongside the NFP report—most notably Retail Sales and S&P Global PMI figures—paint a consistent picture of slowing economic momentum.

Retail Sales: Consumer Momentum Stalls

Retail Sales were unchanged (0.0% MoM) in November, reflecting the impact of a cooling labor market and slowing wage growth. As consumer spending accounts for roughly 70% of U.S. GDP, stagnant retail activity suggests limited near-term upside for economic growth.

Services PMI: The Final Pillar Softens

While U.S. manufacturing has remained in contraction for an extended period, the services sector had been a key source of resilience. However, the latest S&P Global Services PMI flash reading fell to 51.9 from 52.8, with the employment sub-index slipping into contraction.

This deterioration suggests that labor market weakness could persist or intensify into Q1 2026, reinforcing the case for a more cautious growth outlook.

Investor implication: The combination of flat consumption and weakening services activity raises concerns that current equity earnings expectations may be overly optimistic, particularly in cyclical sectors.

Federal Reserve: Policy in Reactive Mode

The Federal Reserve’s 25bp rate cut in December, bringing the policy range to 3.50%–3.75%, signals a clear shift from an inflation-centric stance toward greater sensitivity to labor market conditions. However, monetary policy operates with a 12–18 month lag, meaning the full impact of recent easing may not be felt until late 2026.

If labor market conditions continue to deteriorate, the Fed may be forced into a more aggressive easing cycle, potentially increasing market volatility and amplifying adjustments in interest-rate-sensitive assets.

In other words, if inflation continues to cool or remains contained, the weakening U.S. labor market would likely push the Fed toward a more dovish and accommodative policy path in 2026.

While monetary easing is typically supportive for risk assets and negative for the U.S. Dollar, the current backdrop is more nuanced. If the Fed is unable to engineer a genuine “soft landing,” rate cuts may reflect economic stress rather than policy success, altering the traditional market response.

Market Implications for the US Dollar & US Equities

Given the current outlook, the US Dollar and US equity markets are likely to experience increased volatility in the near term. This environment also presents selective market opportunities through year-end and into early 2026.

U.S. Dollar – Structural Pressure Amid Safe-Haven Support

The US Dollar faces structural downside pressure due to slowing labor market growth and a softer economic outlook, which may prompt the Federal Reserve to consider additional rate cuts. This dynamic generally weighs on the Dollar.

However, the situation is nuanced. If the US economy slows, heightened risk aversion could lead investors to reduce exposure to risk assets, indirectly supporting the Dollar as a global safe-haven asset. At the same time, gold and other traditional safe-haven instruments may also benefit.

Outlook: Short-term volatility is expected, with the Dollar Index likely to trade within a broad consolidation range. Structurally, however, the Dollar remains under downward pressure, with potential support levels between 99–100 as the market prices in further Fed easing.

U.S. Equities – Exercise Caution

Equities are largely priced for continued earnings growth. With labor market moderation and weak consumption, corporate revenue growth may stall. Importantly, weaker economic data no longer guarantees that Fed support will lift markets. In the current environment:

Bad news = Earnings pressure = Stocks under pressure.

Sector Rotation: Investors are increasingly favoring defensive sectors—such as Utilities, Staples, and Healthcare—over cyclical areas like Technology and Consumer Discretionary, reflecting a more cautious approach to risk.

Investor Implications: Short-term volatility is likely. Investors should consider cautious positioning, balancing growth exposure with defensive allocations, and maintaining exposure to potential safe-haven assets like gold and Treasuries.

Strategic Takeaways

- Expect Short-Term Volatility: Equity markets may experience corrections as investors adjust to slower economic growth.

- Focus on Quality & Defensive Sectors: Companies with resilient cash flows and those less reliant on discretionary spending may outperform.

- Monitor Fed Signals: Monetary policy guidance will remain a key driver for USD direction and equity sentiment.

- Cautious Optimism: The economy is not collapsing, but growth momentum is slowing. Investors should recalibrate expectations and prepare for potential market adjustments in Q1 2026.

Conclusion

The December 2025 NFP report signals a structural inflection point for the US economy and financial markets. Labor market moderation, coupled with flat consumption and softening business sentiment, suggests that investors should adopt a cautious stance. While the data does not indicate a full-blown recession, equity markets may face short-term corrective pressures, and the USD may experience structural weakness. In this environment, balanced portfolios, disciplined risk management, and careful attention to Fed policy will be essential as markets navigate this period of moderation.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server