Comprehensive EUR/NZD Analysis for October 11, 2023

In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the EUR/NZD for 11th October 2023.

Key Takeaways

- Pay attention to governors’ speeches: Many Fed governors will speak in public today and pay attention to potential monetary policy attitudes.

- The Palestinian-Israeli conflict supports the US dollar: The recent instability in the Middle East may provide support for the recent weakness of the US dollar, and the euro will be relatively suppressed.

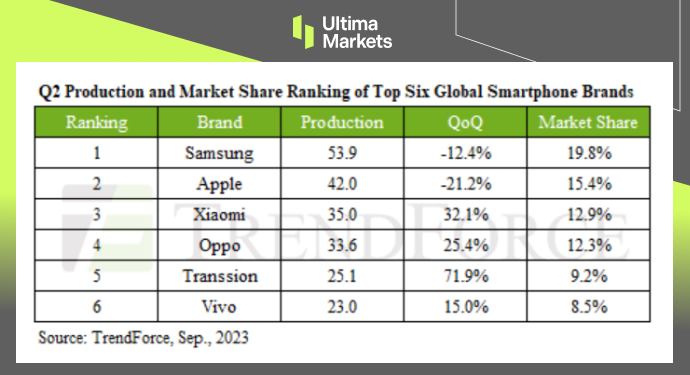

- The RBNZ would hike rates this year: New Zealand’s strong immigration and expansionary fiscal policies this year have weakened the impact of the current interest rate level of 5.5%. The market expects the Reserve Bank of New Zealand to raise the official cash rate to 5.75% in November.

Technical Analysis

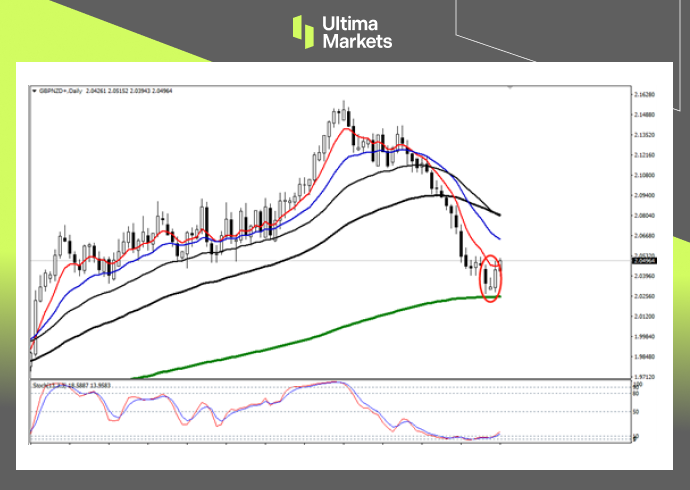

Daily Chart Insights

- Price action: the bar yesterday closed into a Pin Bar, which is a strong bearish signal. The market has greater downward momentum today. However, it is worth noting that if the market breaks through yesterday’s high, it will be another breakthrough price action, and the market will most likely start a bullish trend this week.

- 240-day moving average: The exchange rate has adjusted at the 240-day moving average for two days in the previous period. There is a certain probability of breaking through this support level today.

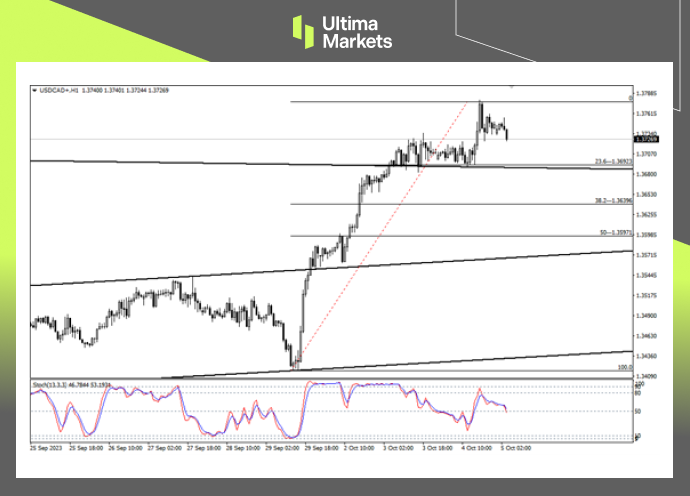

1-Hour Chart Analysis

- Stochastic Oscillator: Technical indicators have shown the upward trend and the market has a certain rebound momentum in the Asian session. For the rebound to turn into an upward reversal, it is necessary to cooperate with the price trend to break through the moving average suppression.

- Moving average : The current rebound of EURNZD is blocked by the blue 17-period moving average and the 33-period moving average. Before breaking through this resistance, the entire trend is still judged to be a rebound.

- Support level: If the subsequent price falls below the intraday low of 1.75284, today’s upward trend will be confirmed as a rebound, and you can pay attention to entry opportunities at that time.

Pivot Indicator

- According to the pivot indicator in Ultima Markets MT4, the central price of the day is established at 1.75552,

- Bullish Scenario: Bullish sentiment prevails above 1.75552, the first target is 1.76025, and the second target is 1.76801

- Bearish Outlook: In a bearish scenario below 1.75552, first target 1.74776, second target 1.74283.

Conclusion

To navigate the complex world of trading successfully, it’s imperative to stay informed and make data-driven decisions. Ultima Markets remains dedicated to providing you with valuable insights to empower your financial journey.

For personalized guidance tailored to your specific financial situation, please do not hesitate to contact Ultima Markets.

Join Ultima Markets today and access a comprehensive trading ecosystem equipped with the tools and knowledge needed to thrive in the financial markets.

Stay tuned for more updates and analyses from our team of experts at Ultima Markets.

Legal Documents

Ultima Markets, a trading name of Ultima Markets Ltd, is authorized and regulated by the Financial Services Commission “FSC” of Mauritius as an Investment Dealer (Full-Service Dealer, excluding Underwriting) (license No. GB 23201593). The registered office address: 2nd Floor, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.