Fundamental factors are like puzzle pieces that shape the big picture of the financial world. These factors can influence the value of assets such as currency pairs, stocks, commodities, and even cryptos. In this article, we will uncover such key factors, which often create opportunities for intelligent investors and traders.

- Geopolitical events:

Geopolitical factors like wars, elections, trade deals, or conflicts can cause ripples in the markets. Positive events can boost investor confidence, while negative news can trigger uncertainty. You are highly recommended to stay updated on global affairs to anticipate how they might impact your trades.

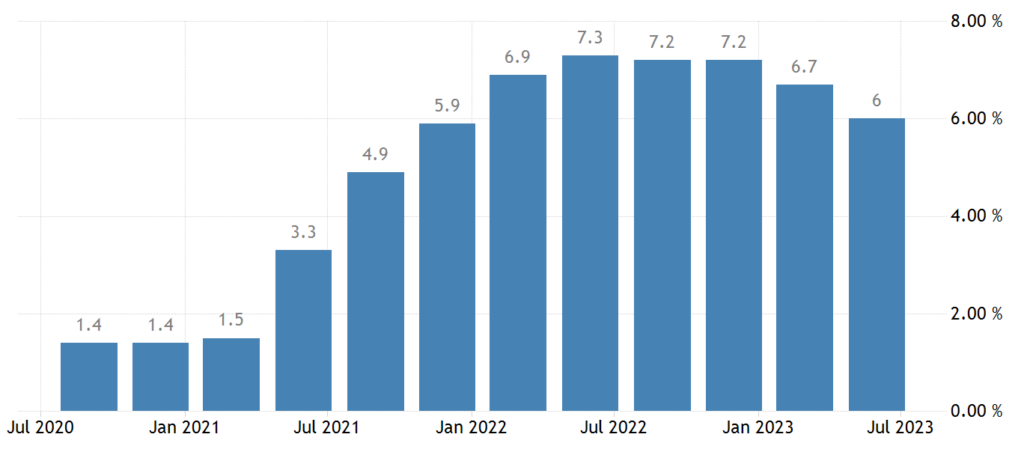

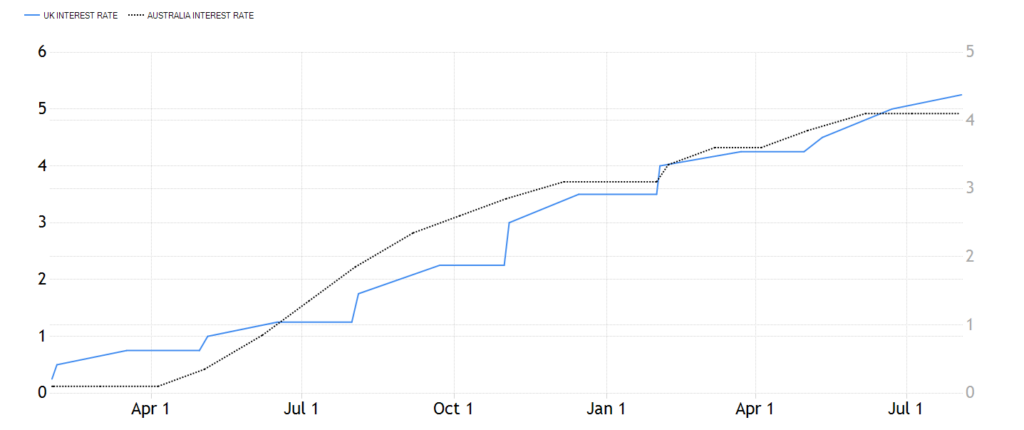

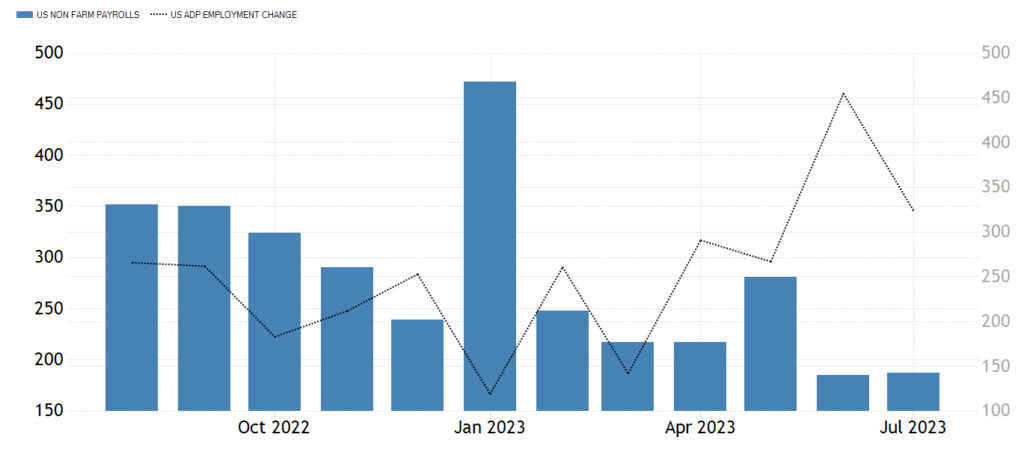

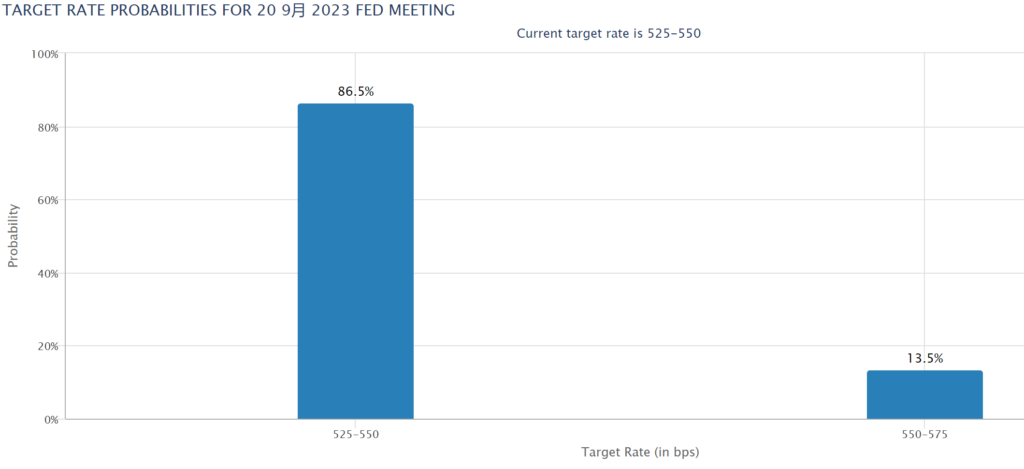

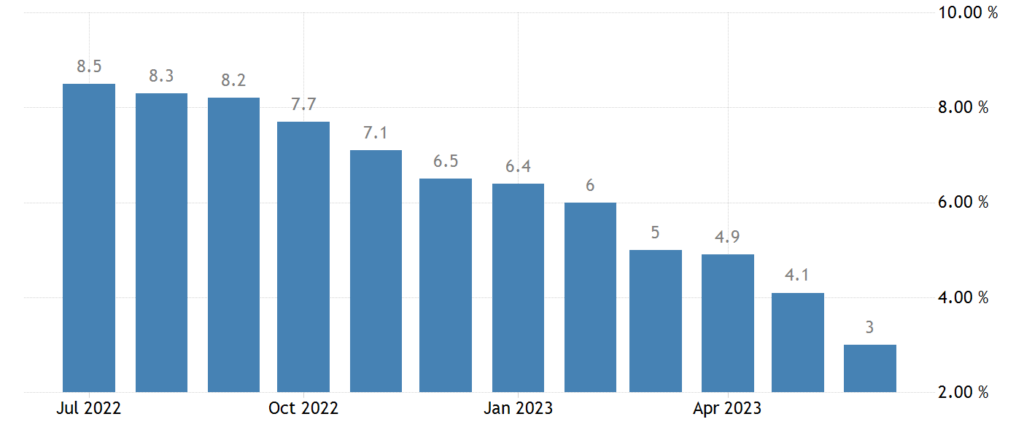

- Economic indicators:

Economic indicators are like the scoreboard, showing the health of a country’s economy. When GDP (Gross Domestic Product) goes up, it’s a sign of economic strength. Low unemployment rates mean people have jobs and money to spend. Inflation, the rise in prices, affects consumers’ buying power. And interest rates set by central banks can make borrowing cheaper or pricier. These indicators affect market sentiment, and understanding them gives you an edge.

- Corporate earnings:

Corporate earnings can reveal how well a company is doing. Strong earnings mean the company is making money, which can lead to higher stock prices. Keep an eye on quarterly reports and profit margins – they’re your insider’s ticket to predicting movements of stocks and indices.

- Natural disaster or climate events:

Imagine you’re a scientist observing nature’s forces. Natural disasters like hurricanes, earthquakes, or droughts can disrupt supply chains and affect commodity prices. Climate events, like changing weather patterns, impact agricultural products. Keeping an eye on these factors helps you anticipate potential market shifts.

- Market sentiment:

Imagine you’re a scientist observing nature’s forces. Natural disasters like hurricanes, earthquakes, or droughts can disrupt supply chains and affect commodity prices. Climate events, like changing weather patterns, impact agricultural products. Keeping an eye on these factors helps you anticipate potential market shifts.

Summary

By understanding fundamental factors, you can predict how the market might change. For example, if an economic indicator suggests a strong economy, you might expect stock prices to rise. If geopolitical tensions increase, currencies might fluctuate.

In a word, fundamental factors are the driving forces behind price movements. Understanding them will give you a competitive edge.