Focus on EUR/USD.

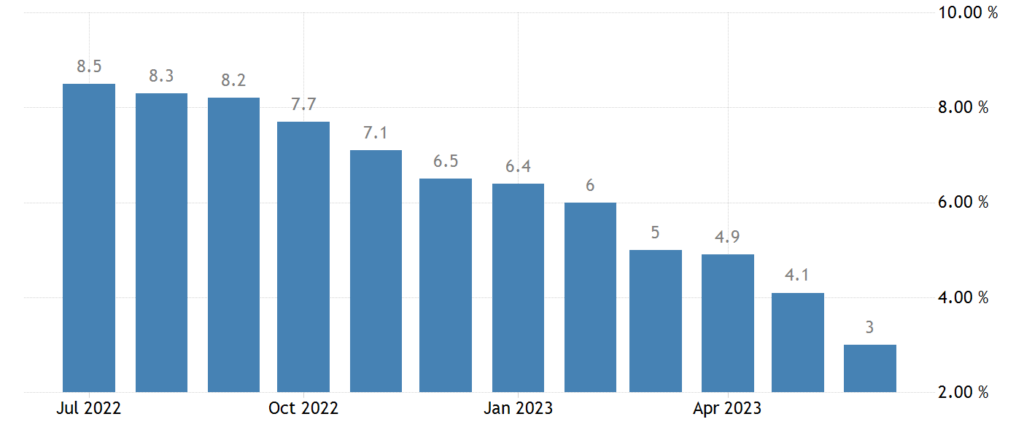

On fundamentals, last week PMI figures in the euro zone reconfirmed the pressure on the European economy, with the manufacturing sector recording 42.7 in July, the lowest manufacturing PMI since 2020. The PMI for the services sector was revised down to 50.9 in July, the lowest up to date. In this context, the market’s expectation for the end of the ECB interest rate hike has fallen from the high of 3.95% in July to the current 3.8%. Investors can wait for the market to digest the interest rate difference between Europe and the United States, and then pay attention to the impact of more economic data on the future.

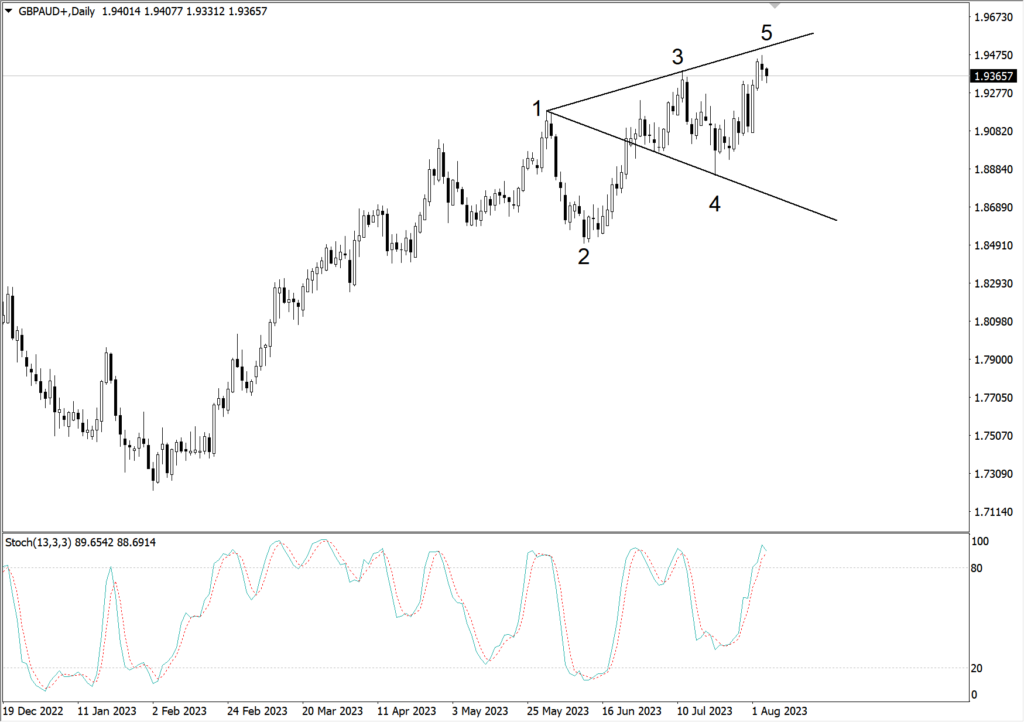

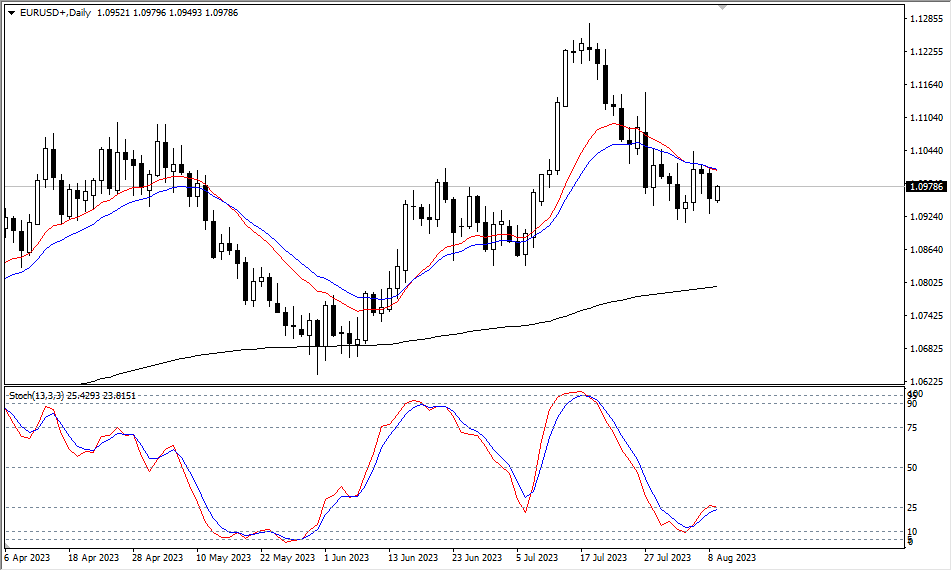

Technically speaking, in EUR/USD daily cycle, the short-term moving averages formed by the 15-day and 21-day suppressed the rise of the exchange rate in the short run. Although it fell below Monday’s low yesterday, there are still bullish opportunities.

(EUR/USD daily cycle, Ultima Markets MT4)

The stochastic oscillator formed a golden cross gesture last week, and there is a bullish potential, but it can only be clarified after the suppression of the short-term moving averages reverses.

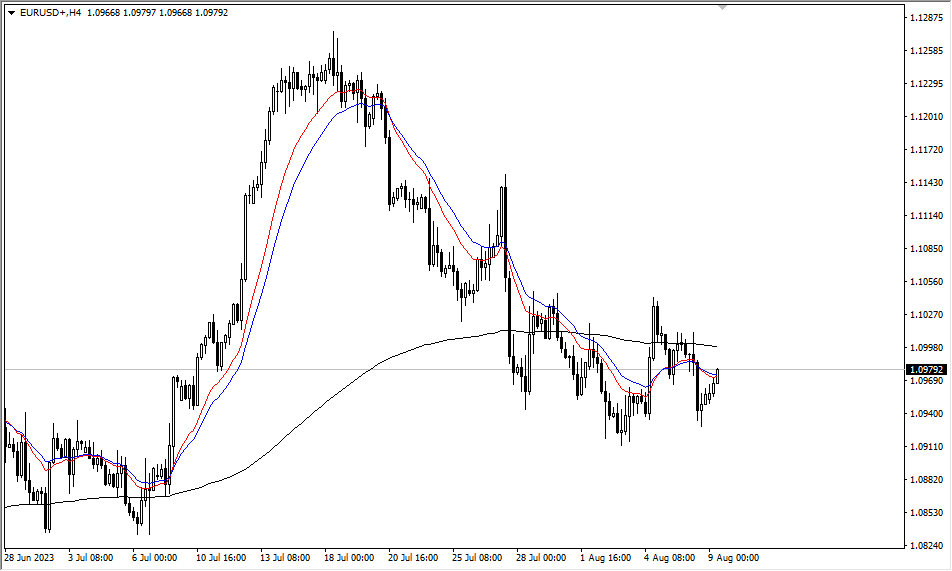

(EUR/USD 4 -hour cycle, Ultima Markets MT4)

In the 4- hour cycle, the exchange rate doesn’t form an effective long structure, and still needs to wait for the confirmation of moving averages and price actions. It is necessary to watch out for any bearish strike in the short term.

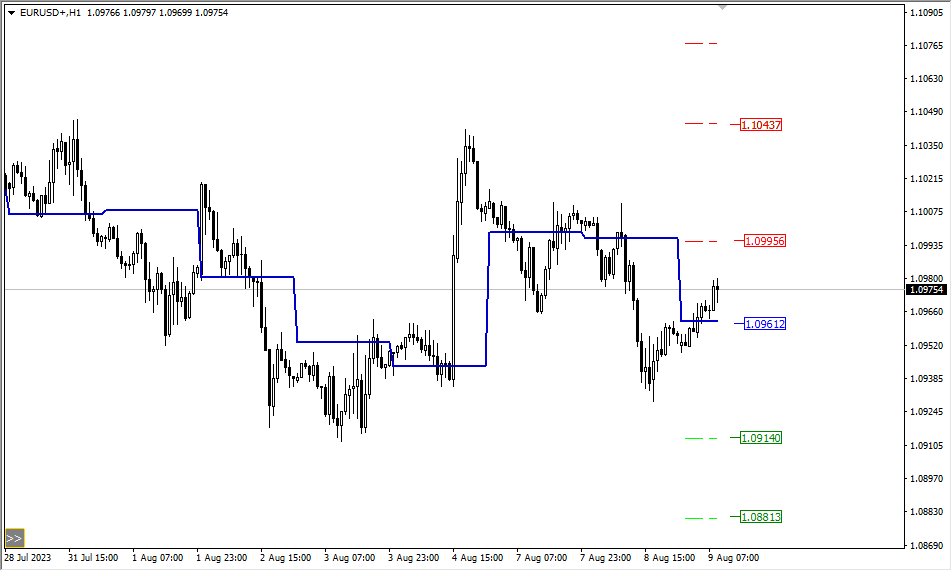

(EUR/USD 1 -hour cycle, Ultima Markets MT4)

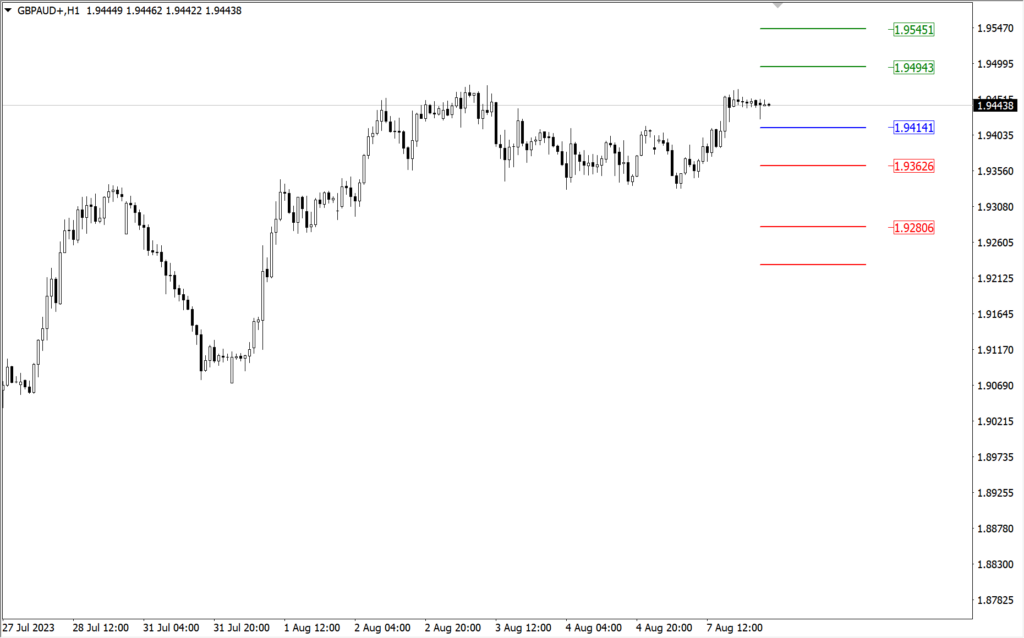

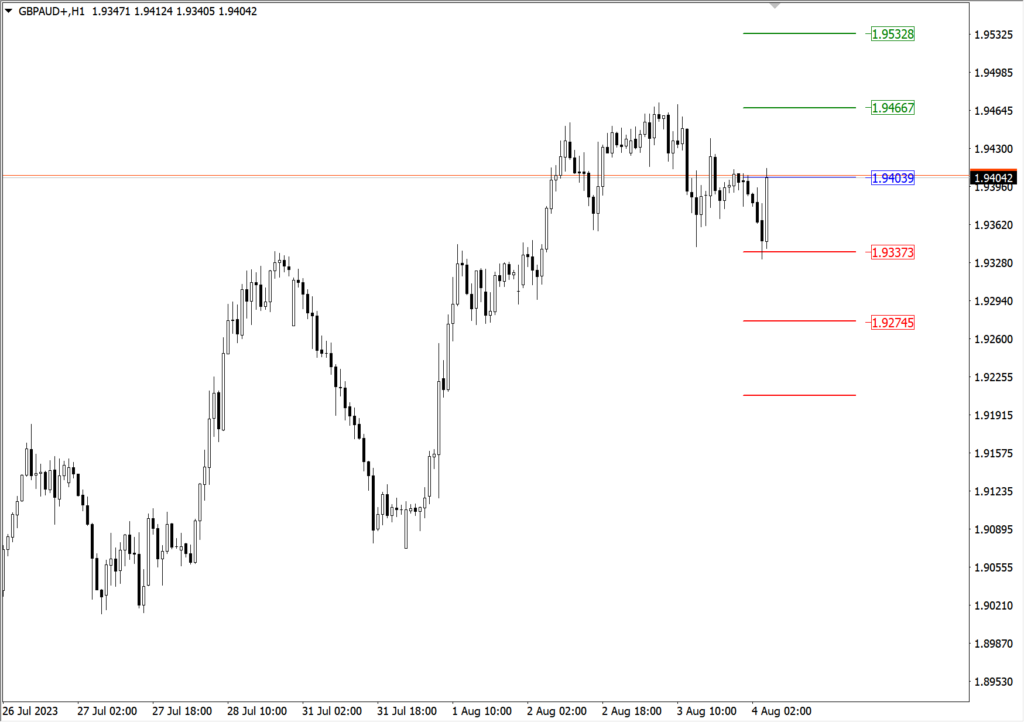

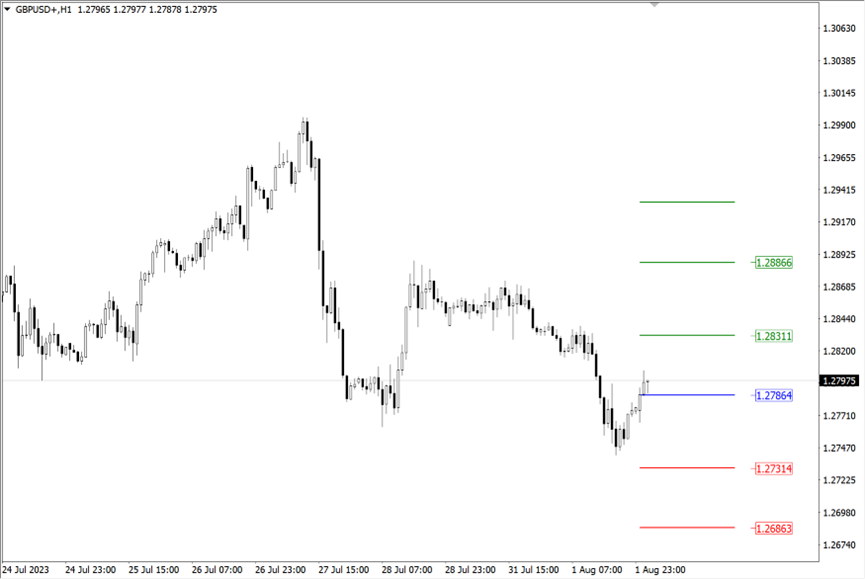

According to the pivot indicator, the central price of the day is 1.09612,

Bullish above 1.09612, the first target is 1.09956, and the second target 1.10437.

Bearish below 1.09612, the first target is 1.09140, and the second target 1.08813.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.