Airlines Issue Profit Warnings as Cost Pressure Rises

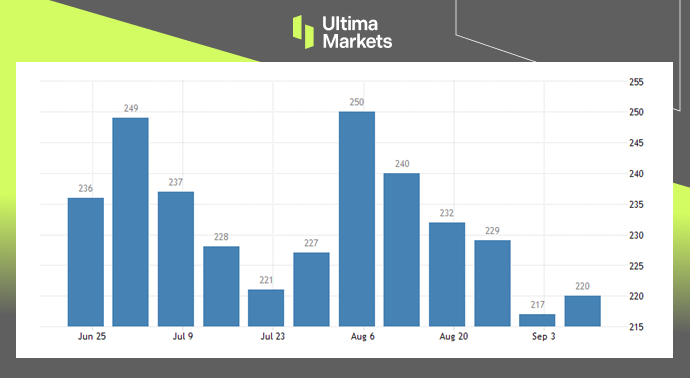

Last week, American Airlines and Spirit Airlines joined other airlines in issuing profit warnings that rising costs would hit profits during the peak summer season, as airlines begin reporting third-quarter results in mid-October.

Consequences for Airlines

American Airlines said it expects adjusted earnings per share in the third quarter to be between 20 cents and 30 cents, down from its previous forecast of 95 cents per share, citing higher fuel prices and new labor deals. The airline cut its operating profit margin in half from its forecast earlier this summer to 4% to 5%.

Spirit Airlines expects negative profit margins of up to 15.5% in the three months ended September 30, down from its previous forecast of -5.5% to -7.5%. The airline also lowered its revenue forecast for the third quarter.

Frontier Airlines said, “In recent weeks, sales have been trending below historical seasonality patterns” and forecasted an adjusted loss for the quarter. The airline’s shares hit a 52-week low.

Outlook for the Industry

Airlines have lost the pricing power they gained last summer as lockdown eased and capacity constrained. Now they face a slow season when travel demand traditionally slows.

Fare tracking company Hopper said: “Fare prices are expected to continue to decline during the fall off-season, with domestic U.S. fares averaging $211 in September and October, down 30% from the summer peak.”

(Global Airlines ETF ticker: JETS, US Global Investors)

Conclusion

The airline industry finds itself at a critical juncture, navigating through a turbulent environment marked by rising costs, shrinking profit margins, and waning pricing power.

The third-quarter results will serve as a litmus test, shedding further light on the industry’s ability to adapt and prosper in the face of these formidable challenges.

As stakeholders watch closely, adaptability and resilience will be key to ensuring a successful flight through these trying times.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.