Focus on gold.

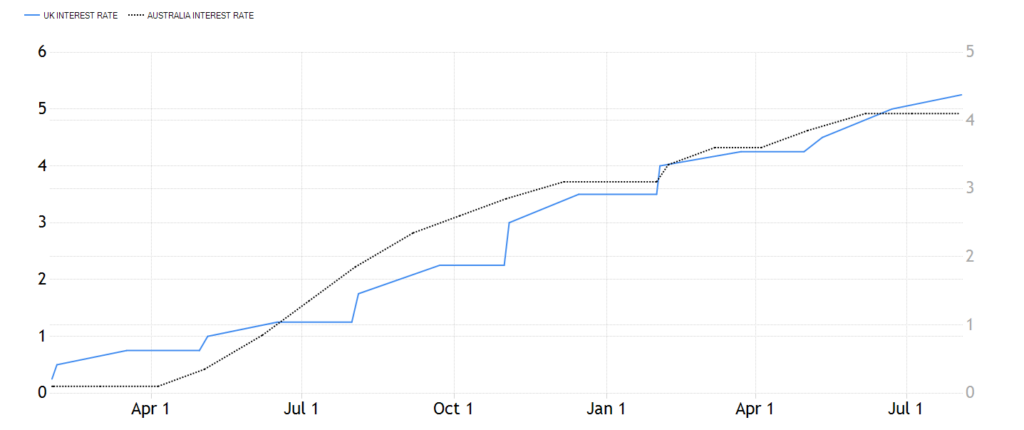

Fundamentally speaking, the US released retail sales in July increased by 0.7% mom. The figure for June was also revised up to 0.3% from 0.2%, suggesting the U.S. economy continued to expand in 3Q and avoid recession. Consequently, inflation stays still in the short run. With demand remaining resilient and labor market tightening, curbing inflation has become a tricky problem for the FED. We believe gold is heading for a bounce.

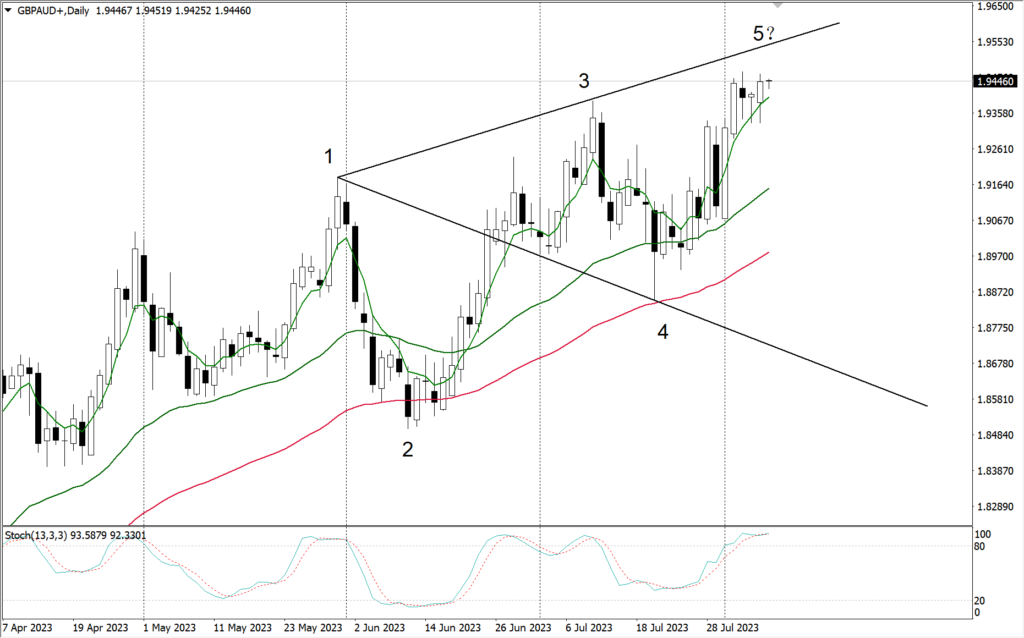

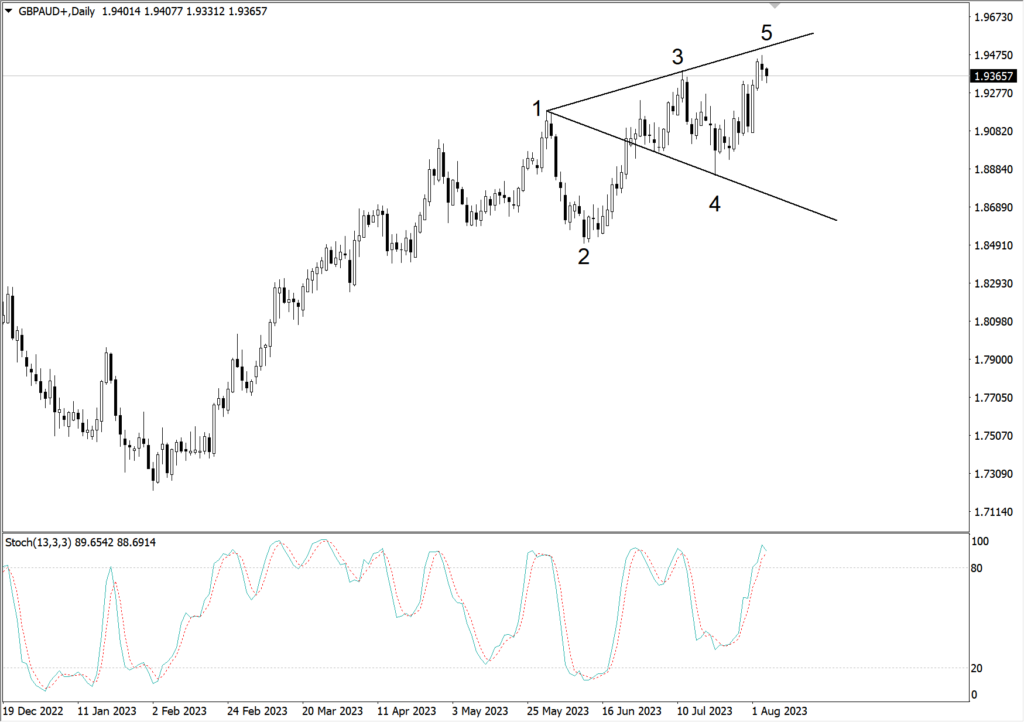

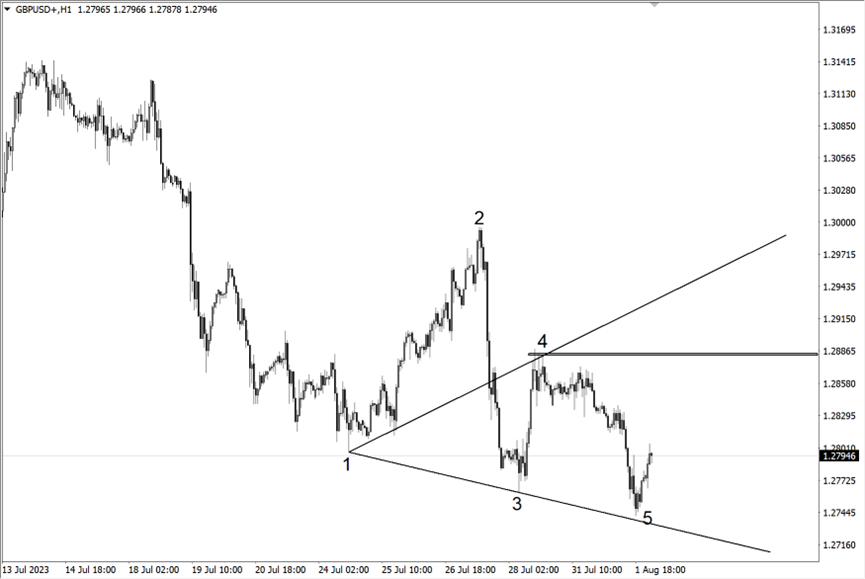

Technically speaking, the gold daily has come to a key support zone – the 240-day moving average .

(Gold daily cycle, Ultima Markets MT4)

The 240-day moving average has been a supportive position for gold since 2022. The gold price made small fluctuations in the supportive zone during the past week, nevertheless, the stochastic oscillator signaled a golden cross yesterday.

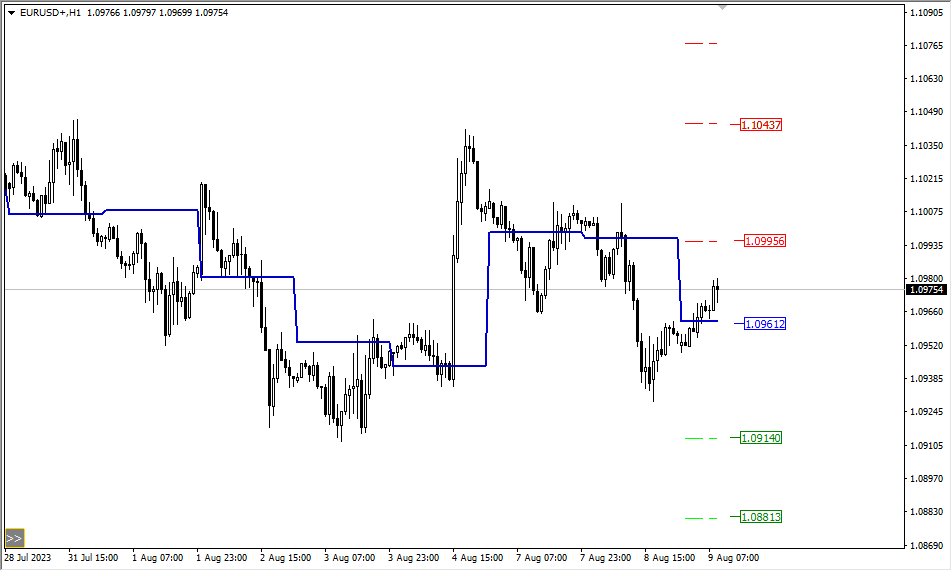

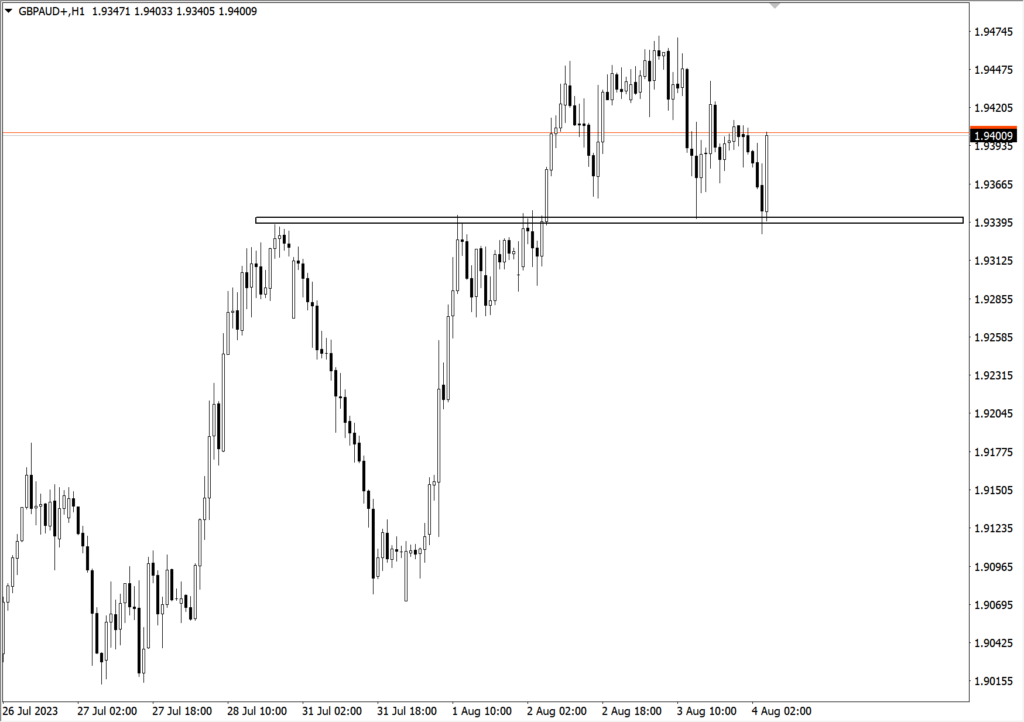

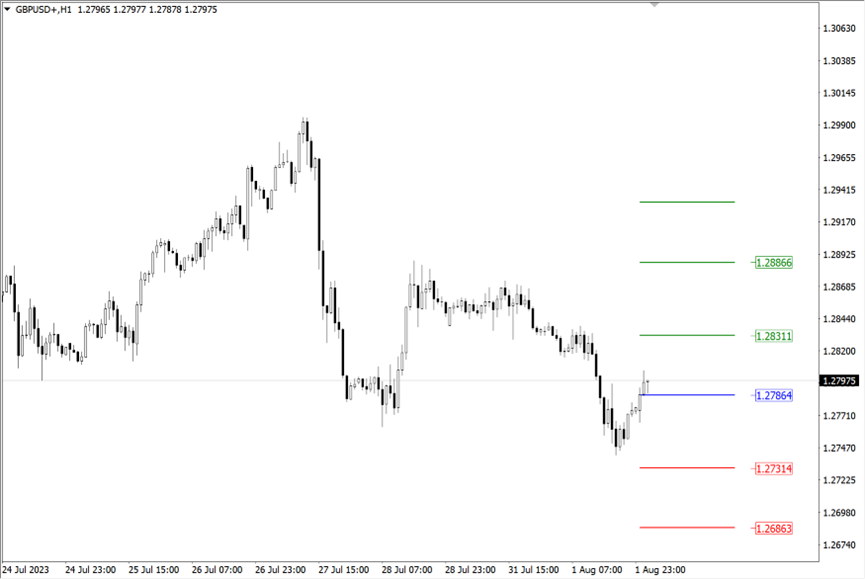

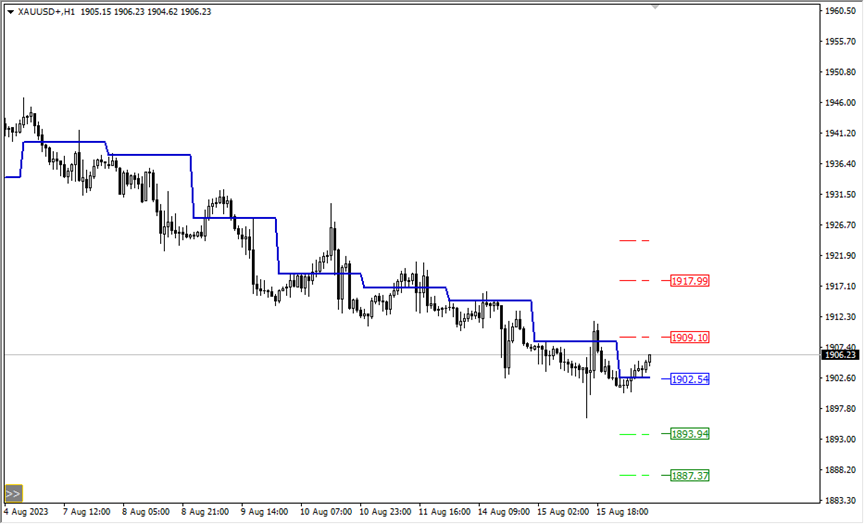

(Gold in 1- hour period, Ultima Markets MT4)

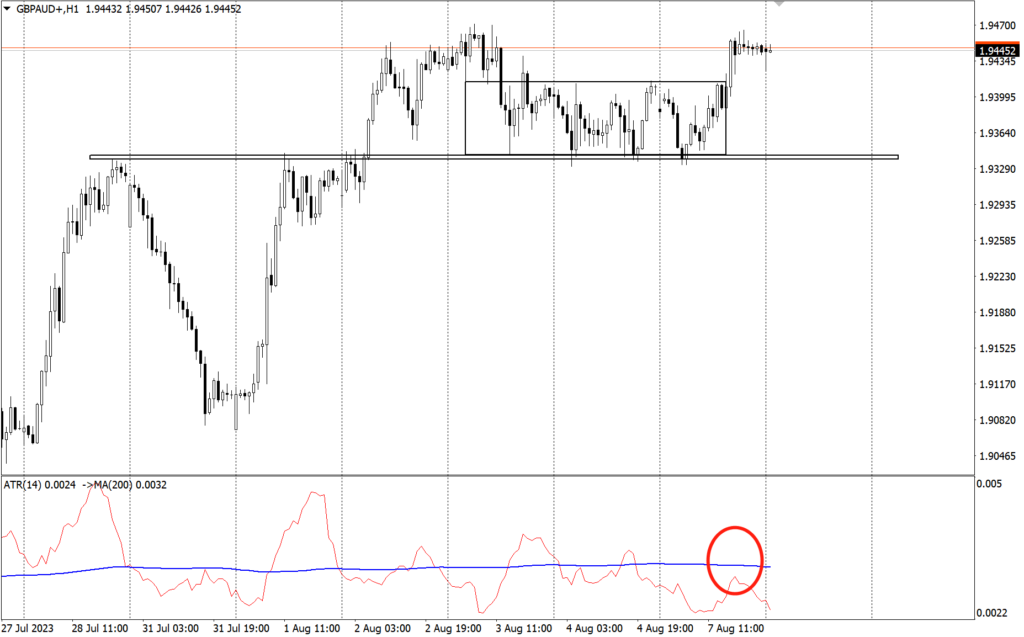

In 1-hour period, the gold price went down again after stepping back on the 65 – period moving average yesterday, but it did not fall below the previous low. Looking at the overall structure, the gold price has a probability of forming a bottom structure. After the price breaks through the previous suppressed position, please make sure if the ATR combination indicator shows an effective breakthrough.

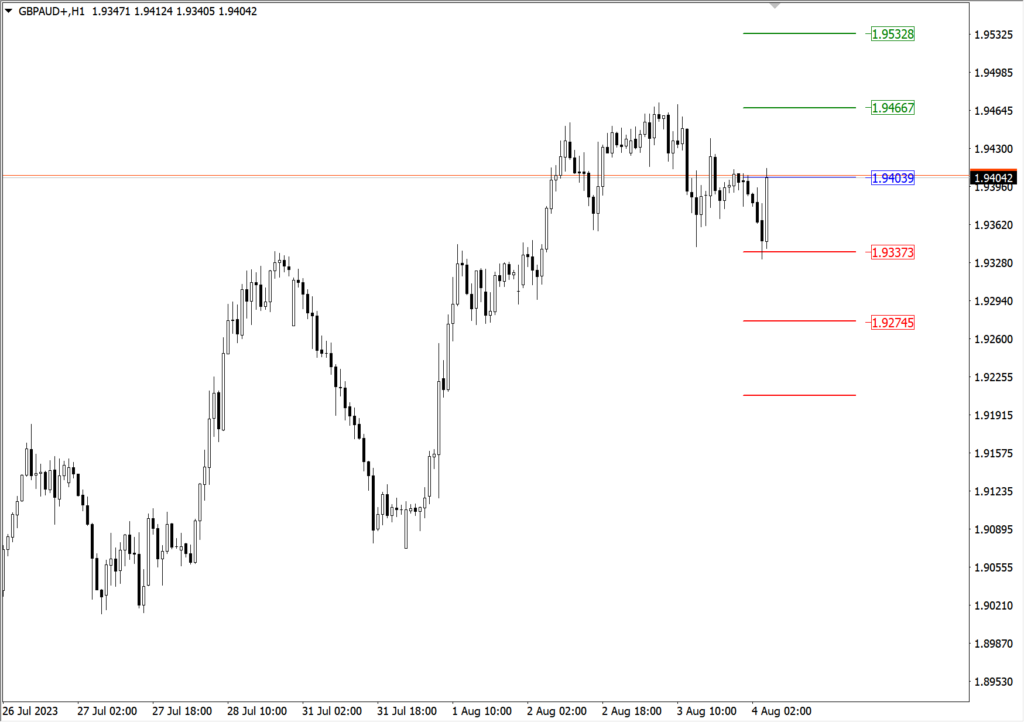

(Gold in 1- hour cycle, Ultima Markets MT4)

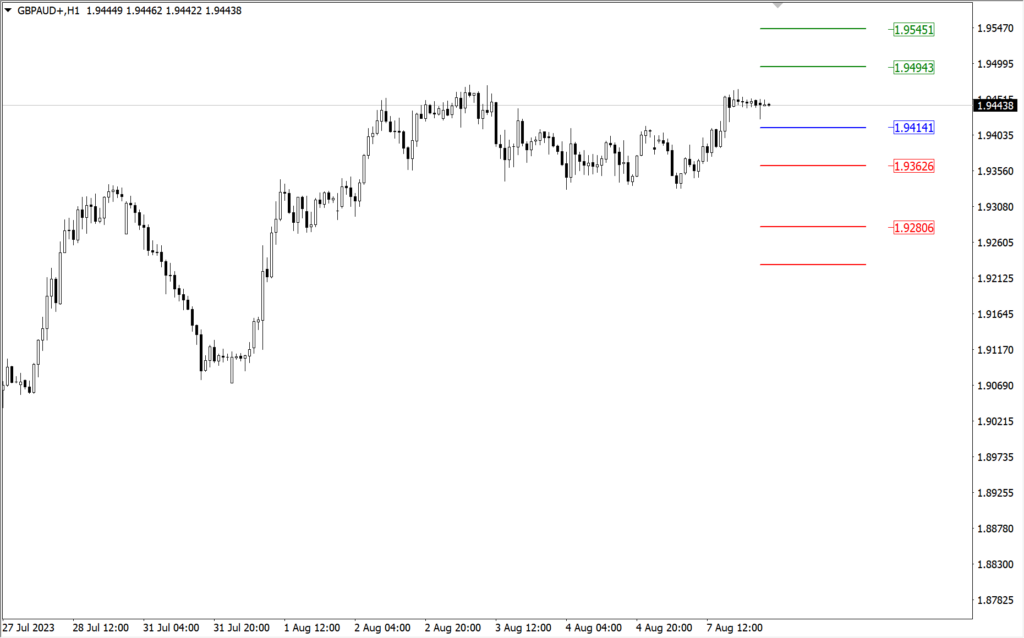

According to the pivot indicator in Ultima Markets MT4, the central price is 1902.54,

Bullish above 1902.54, the first target is 1909.10, and the second target 1917.99.

Bearish below 1902.54, the first target is 1893.94, and the second target 1887.37.

Disclaimer Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.